Market News

- Meredith Whitney on Iran War's Impact on Affordabilityon March 9, 2026 at 9:37 pm

Meredith Whitney Advisory Group CEO Meredith Whitney discusses affordability, consumer burdens, and the market reactions to President Trump's comments that the war Iran could possibly end soon. She talks with Romaine Bostick and Katie Greifeld on "The Close." (Source: Bloomberg)

- Iran Conflict Could Boost LNG Trade Through the Panama Canalby Michael D McDonald on March 9, 2026 at 9:35 pm

The ongoing conflict in Iran could lead to an increase in traffic at the Panama canal from Asian energy buyers seeking alternative LNG sources, canal administrator Ricaurte Vasquez said in an interview with Bloomberg TV.

- Ventilation and Filtration System Firm Madison Air Files for IPOby Bailey Lipschultz on March 9, 2026 at 9:34 pm

Madison Air Solutions Corp., a provider of ventilation and filtration systems, filed for an initial public offering Monday.

- Digital Laura Martinon March 9, 2026 at 9:19 pm

Netflix’s stock price is staging a dramatic reversal triggered by management’s decision to walk away from its proposed acquisition of Warner Bros. Discovery late last month. The streaming giant emerged as the favorite to buy Warner in early December and agreed to a $72 billion acquisition on Dec. 5 that eventually increased to $83 billion. Netflix shares immediately fell, as investors worried that the deal would distract the company from its core business and Netflix didn’t need the deal for growth. Along the way, Paramount Skydance surfaced as another suitor for Warner and refused to drop its bid even after Warner said it preferred Netflix. A bidding war ensued, and Paramount won on Feb. 27, when Netflix stepped aside. Laura Martin, Needham Senior Analyst, joins Bloomberg Businessweek Daily to discuss. She speaks with Carol Massar and Norah Mulinda. (Source: Bloomberg)

- AMC’s Deutsche Bank Debt Deal Rewards Market Return Within Year

AMC Entertainment Holdings Inc. turned to an existing creditor to refinance debt after turbulence […]

- Trump Signals Iran War Could End Soon

President Donald Trump signaled the US war on Iran could be ending soon, saying the operation was […]

- Panama Canal Ready to Handle More Traffic, Administrator Says

Panama Canal Authority Administrator Ricaurte Vásquez Morales discusses the rise in agriculture […]

- US Airline Bonds Weaken as Mideast War Lifts Jet Fuel Costs

US airline-company debt weakened on Monday after soaring jet fuel costs stirred investor fears […]

- Pixar Scores Comeback With $45.3 Million Haul for ‘Hoppers’

Hoppers, the new animated picture from Walt Disney Co.’s Pixar studio, debuted as the […]

- Oil Wipes Out Gains to Trade Below $90 in Wild Trading Session

Oil’s wild ride continued late Monday as futures moved lower in post-settlement trading that took […]

- Stocks Climb as Trump Hints War Could Be Over Soon: Markets Wrap

Wall Street staged a dramatic comeback, with stocks and bonds rebounding on hopes the 10-day-old […]

- Gold Pares Losses as Dollar Weakens After Trump Remarks on War

Gold pared losses as the dollar pushed lower after US President Donald Trump signaled the US war on […]

political news

- Trump Says Iran War Will Be 'Finished Pretty Quickly'on March 9, 2026 at 9:42 pm

“It’s going to be finished pretty quickly,” President Donald Trump says during an event in Florida referencing the war in Iran. (Source: Bloomberg)

- Trump’s Trio of NJ Successors to Habba Ruled Illegally Appointedby David Voreacos on March 9, 2026 at 9:33 pm

A US judge ruled Monday that the Trump administration illegally appointed a trio of lawyers to succeed Alina Habba after her resignation as the top federal prosecutor in New Jersey.

- GOP Leader Warns Trump Against Muscling Senate on Voting Billby Steven T. Dennis, Matt Shirley on March 9, 2026 at 9:32 pm

President Donald Trump’s efforts to force Senate Republicans to pass a partisan overhaul of voting laws risks bringing congressional business to a halt with no clear path to success, Senate Majority Leader John Thune warned Monday.

- Trump Weighs Several Options to Tame Surging Gasoline Pricesby Ari Natter, Jennifer A Dlouhy, Josh Wingrove on March 9, 2026 at 8:33 pm

President Donald Trump is mulling a menu of possible options to combat surging oil and gasoline prices in the wake of the Iran war, according to people familiar with the matter.

- Some Outstanding Questions About the War With Iranby Nathan R Dean on March 9, 2026 at 8:31 pm

Trump weighs his next steps in the conflict as oil prices surge.

- Gold Pares Losses as Dollar Weakens After Trump Remarks on War

Gold pared losses as the dollar pushed lower after US President Donald Trump signaled the US war on […]

- Iran Signals No Letup in War as Khamenei’s Son Made Leader

Iran chose Mojtaba Khamenei, the hardline son of the assassinated Ayatollah Ali Khamenei, as its […]

- Pakistan Plans Fuel-Saving Steps After Oil Jump Sparks Panic

Pakistan’s government has implemented fuel-saving measures after oil surged above $100 and gas […]

- European Rate Bets Scrambled as Oil Volatility Grips Markets

Just a month ago, European Central Bank President Christine Lagarde declared that inflation was in […]

- Two Charged in ISIS-Inspired Attack Outside NYC Mayor’s Home

Federal prosecutors charged two men for allegedly bringing improvised explosive devices to a […]

Wealth

- The UK’s Key Economic Hope for 2026 Lies Dashedby John Stepek on March 9, 2026 at 1:49 pm

If the Iran War lasts much longer, interest rate cuts may be off the menu.

- Gen Z’s ‘Financial Nihilism’ Finds Outlet in Prediction Bets, Cryptoby Suzanne Woolley on March 9, 2026 at 1:00 pm

Being financially “behind” is fueling moves into higher-risk and speculative assets as a way to catch up, according to a survey.

- Timely Gold Bet Yields 1,994% Return for Billionaire Familyby Ari Altstedter on March 9, 2026 at 11:00 am

For the Lundins, a Swedish-Canadian family that controls a multibillion-dollar mining and oil empire, C$17.5 million may not seem like a big investment. But it becomes so when it delivers a 1,994% return.

- Kalshi Teams Up With Brazil’s XP for First International Pushby Katherine Doherty, Matheus Piovesana on March 9, 2026 at 4:00 am

Prediction market platform Kalshi Inc. is expanding outside the US for the first time, partnering with Brazil’s XP Inc. to list event contracts.

- Asia’s Rich Having Second Thoughts on Dubai as War Ragesby Chanyaporn Chanjaroen, Denise Wee, Filipe Pacheco, Venus Feng on March 9, 2026 at 2:00 am

Many of Asia’s richest families are reconsidering their exposure to Dubai as the Iran war rattles the city that has attracted billions from across the region in recent years.

Tech & Innovation

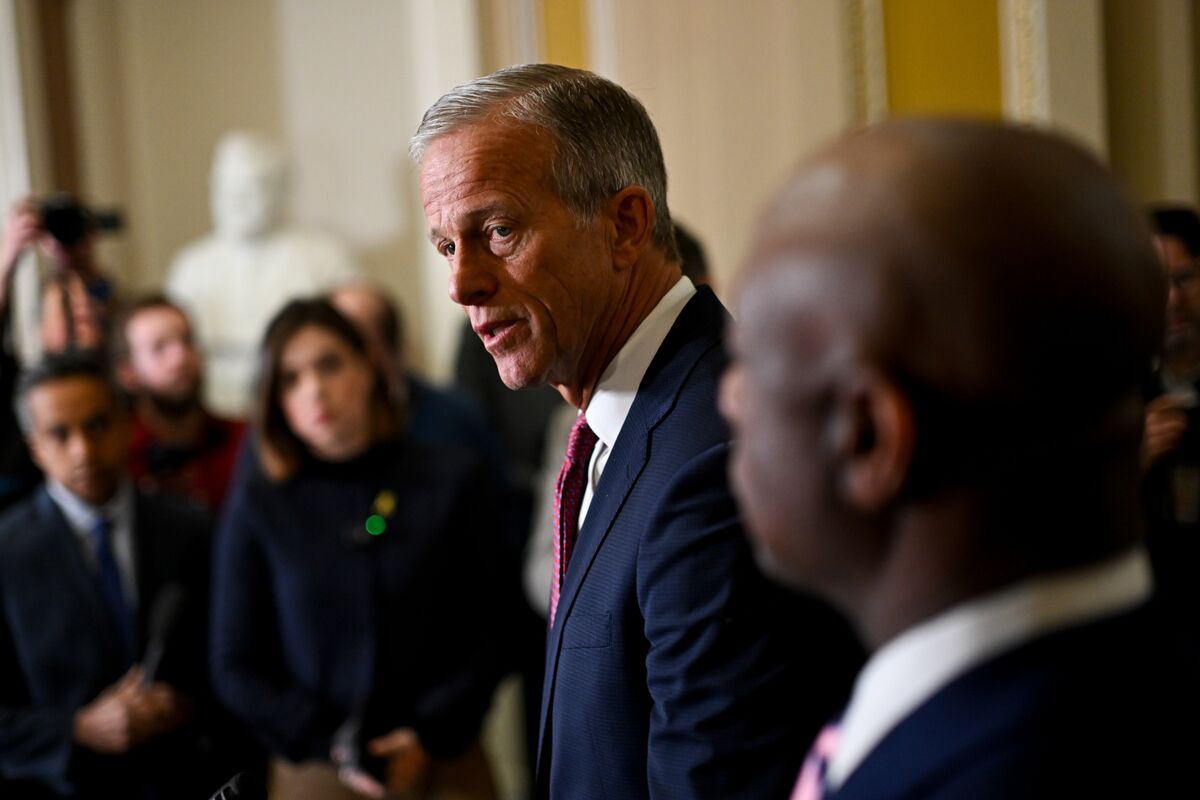

- HPE Projects Sales That Top Estimates on AI Hardware Demandby Dina Bass on March 9, 2026 at 8:11 pm

Hewlett Packard Enterprise Co. gave an outlook for revenue in the current quarter that exceeded analysts’ estimates, a sign the company is benefiting from solid demand for hardware that helps customers run AI workloads.

- Oracle, OpenAI End Plans to Expand Flagship Data Center | Bloomberg Tech 3/9/2026on March 9, 2026 at 7:59 pm

Bloomberg’s Caroline Hyde and Ed Ludlow discuss the impact of the ongoing conflict in the Middle East. Plus, Oracle and OpenAI scrap plans to expand a flagship data center project in Texas. And, Anthropic sues the US Department of Defense after the government labeled the AI firm a supply chain risk. (Source: Bloomberg)

- Alger's Ankur Crawford: Demand for Compute is Insatiableon March 9, 2026 at 7:53 pm

Alger Executive Vice President and Portfolio Manager Ankur Crawford discusses an insatiable demand for AI computing, gold, and a "directionless" and "choppy" market. She talks with Romaine Bostick and Katie Greifeld on "The Close." (Source: Bloomberg)

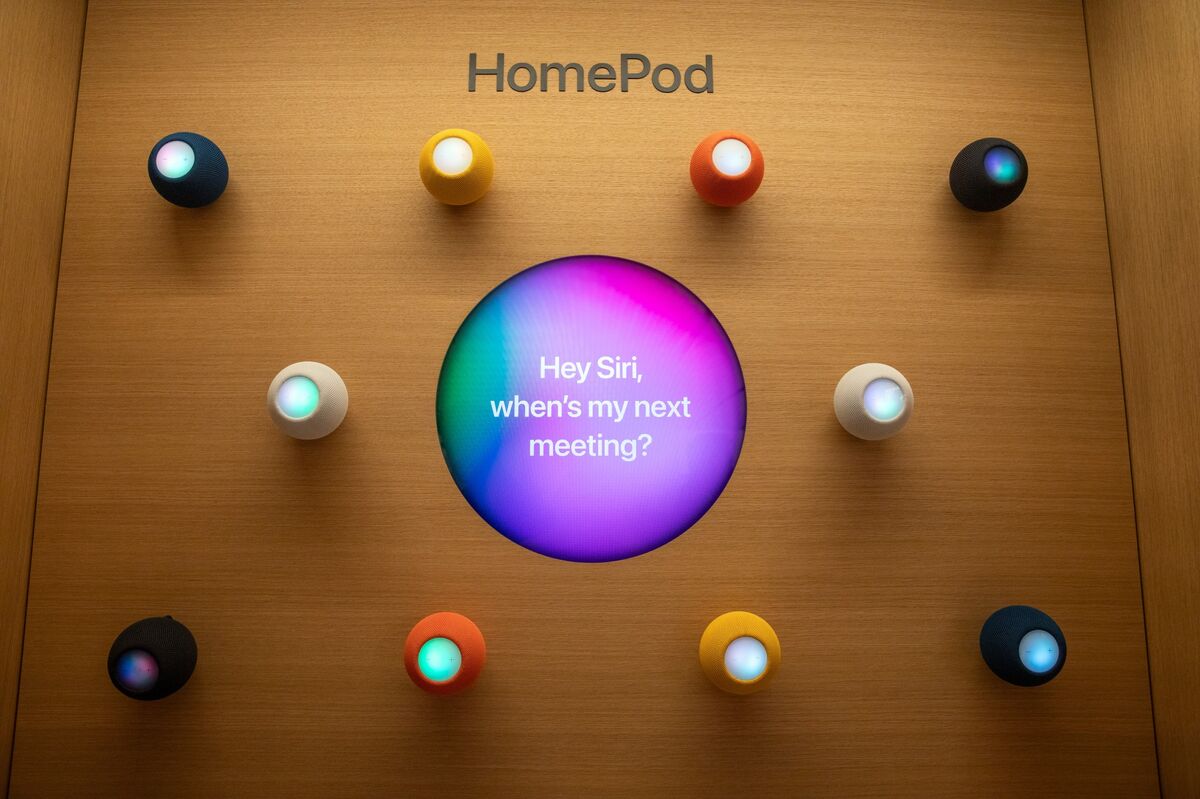

- Apple Postpones Smart Home Display Launch as It Waits for New AI and Siriby Mark Gurman on March 9, 2026 at 6:42 pm

Apple Inc.’s artificial intelligence struggles are rippling through its product plans, forcing the company to delay a long-in-the-works smart home display until later this year, according to people with knowledge of the matter.

- Consumers Embrace More Gen-AI Appson March 9, 2026 at 6:40 pm

OpenAI and Anthropic are becoming their own artificial intelligence app stores and consumers are embracing a wider number of generative AI tools, according to Andreessen Horowitz’s “Top 100 Gen AI Consumer Apps” report. Olivia Moore, partner at A16Z and author of the report, discusses the findings with Caroline Hyde and Ed Ludlow on “Bloomberg Tech.” (Source: Bloomberg)

Editor's Picks

To understand the new politics stance and other pro nationals of recent…

Travel

To understand the new politics stance and other pro nationals of recent…

UK News

To understand the new politics stance and other pro nationals of recent…

Science

To understand the new politics stance and other pro nationals of recent…

Economy

To understand the new politics stance and other pro nationals of recent…