- Bozoma Saint John on Branding, AI's Impact, Super Bowlon February 4, 2026 at 11:55 pm

Bozoma Saint John, former Chief Marketing Offiver of Netflix and former chief brand officer of Uber, discusses the tech and media landscape and the Super Bowl with Romaine Bostick and Katie Greifeld on The Close. She says evolution is key to everything. (Source: Bloomberg)

- Why a Snap Election Is a Gamble for Japan’s Leaderby Yoshiaki Nohara on February 4, 2026 at 11:52 pm

Japan is preparing for a snap lower-house election that could reshape the country’s political balance at a moment of economic strain and regional uncertainty.

- Phillips 66 CEO: Chemicals at Bottom of 'Very Tough Cycle'on February 4, 2026 at 11:48 pm

Mark Lashier, Phillips 66 CEO, says the chemicals business is at the bottom of a tough cycle and remains bullish on its long-term fundamentals. He tells Romaine Bostick and Katie Greifeld on The Close the business will eventually turn. (Source: Bloomberg)

- Stocks Slide as Tech Selloff Persists Ahead of Google Earnings | Closing Bellon February 4, 2026 at 11:41 pm

Comprehensive cross-platform coverage of the U.S. market close on Bloomberg Television, Bloomberg Radio, and YouTube with Romaine Bostick, Katie Greifeld, Carol Massar and Tim Stenovec. (Source: Bloomberg)

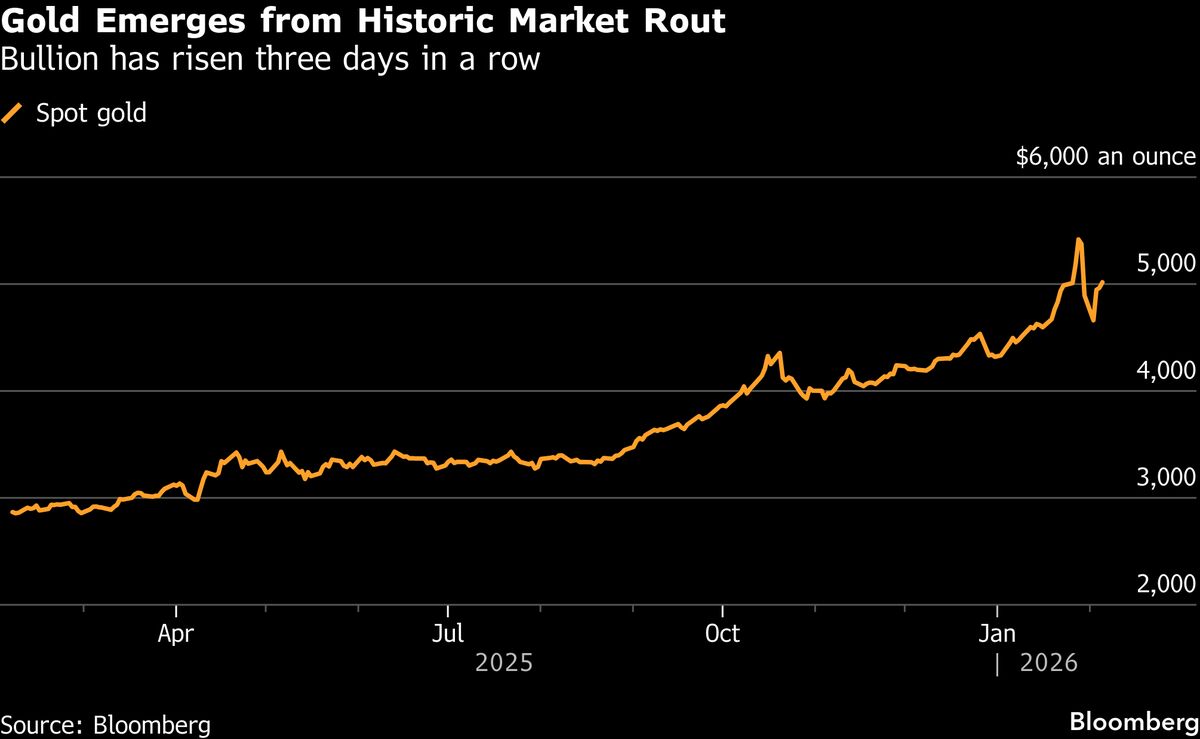

- Gold Rises for a Third Day in Recovery From Historic Market Routby Yihui Xie on February 4, 2026 at 11:23 pm

Gold rose, pushing back above $5,000 an ounce, as dip buyers continued to snap up bullion after a historic plunge from an all-time high.

- Gold, Silver Recover From Rout as Traders Search for Catalystson February 4, 2026 at 11:15 pm

Gold dipped below $5,000 an ounce, but recovered after last week's historic price plunge, as traders hunt for fresh catalysts. Silver also recovered as both precious metals have been in a listless pattern amid geopolitical risk and speculative momentum. Gold volatility has reached a 17-year high and silver volatility is at its highest since 1980. Axel Merk, President and Chief Investment Officer of Merk Investments, joins Bloomberg Businessweek Daily to discuss. He speaks with Carol Massar and Tim Stenovec. (Source: Bloomberg)

- Oil Declines After Iran Confirms US Negotiations Set for Fridayby Nicholas Lua on February 4, 2026 at 11:11 pm

Oil fell for the first time in three days after Iran confirmed it would hold negotiations with the US, easing the immediate risk of military strikes against the OPEC producer.

- Bank Consolidation Remains Beneficial: ConnectOne CEOon February 4, 2026 at 11:10 pm

Frank Sorrentino, Founder and CEO of ConnectOne Bank, joins Bloomberg Businessweek Daily to discuss the state of regional banks as Santander snaps up Webster for $12 billion in a push for US expansion. Sorrentino says smaller banks benefit from consolidation as clients move from firm to firm and bank product options change. He also discusses the state of the consumer and the housing market as the Trump administration mulls different housing-related proposals centered around affordability. Sorrentino speaks with Carol Massar and Tim Stenovec. (Source: Bloomberg)

- Bets on Big Takaichi Win Set Japanese Stocks on Path to Rallyby Hideyuki Sano, Alice French on February 4, 2026 at 11:00 pm

Stock investors are positioning for a decisive election victory by Prime Minister Sanae Takaichi this Sunday, betting that a strong mandate will allow her to consolidate power and push through expansive fiscal policies.

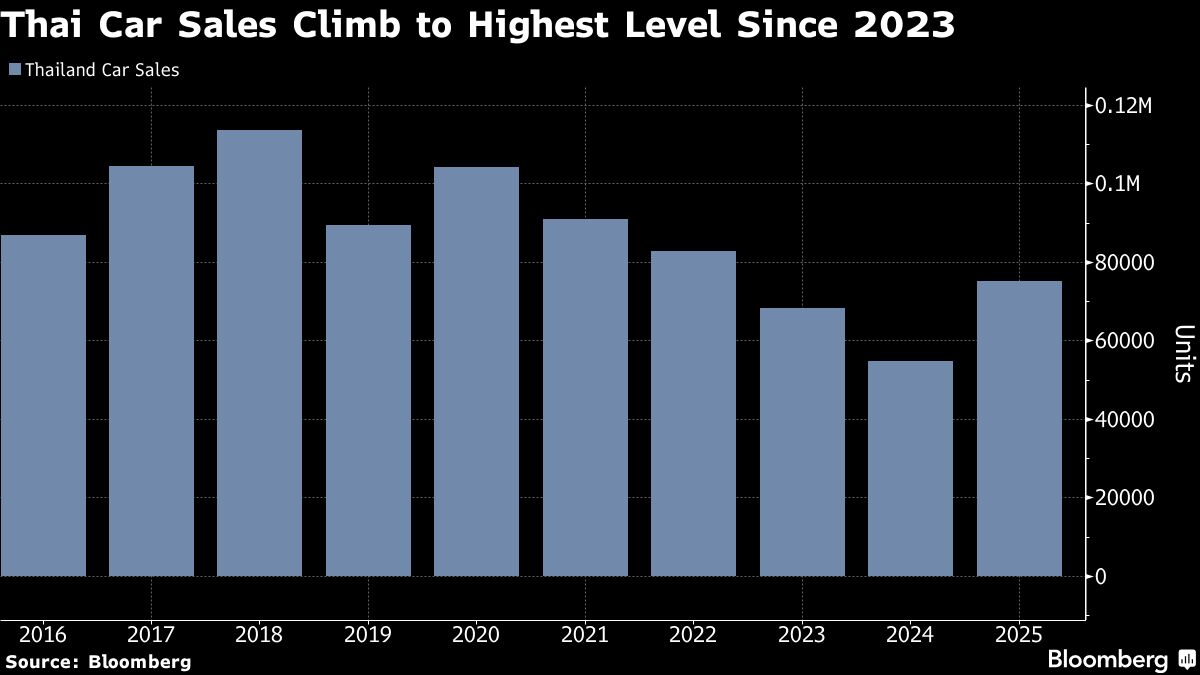

- Billionaire Clan Is Said to Weigh $2 Billion Thai Summit Saleby Cathy Chan, Manuel Baigorri on February 4, 2026 at 11:00 pm

Thai Summit Group, the Southeast Asian country’s largest auto-parts manufacturer, is weighing a sale of its business amid mounting pressure from the global shift to electric vehicles, political uncertainty and family succession gaps, according to people familiar with the matter.

- Chinese Stocks Have a New Headache as Taxman Tightens Scrutinyby Jeanny Yu, April Ma, Mengchen Lu on February 4, 2026 at 11:00 pm

Chinese stocks are encountering a fresh hurdle as Beijing ramps up efforts to collect corporate taxes, a move that threatens to pressure earnings in a fragile economy.

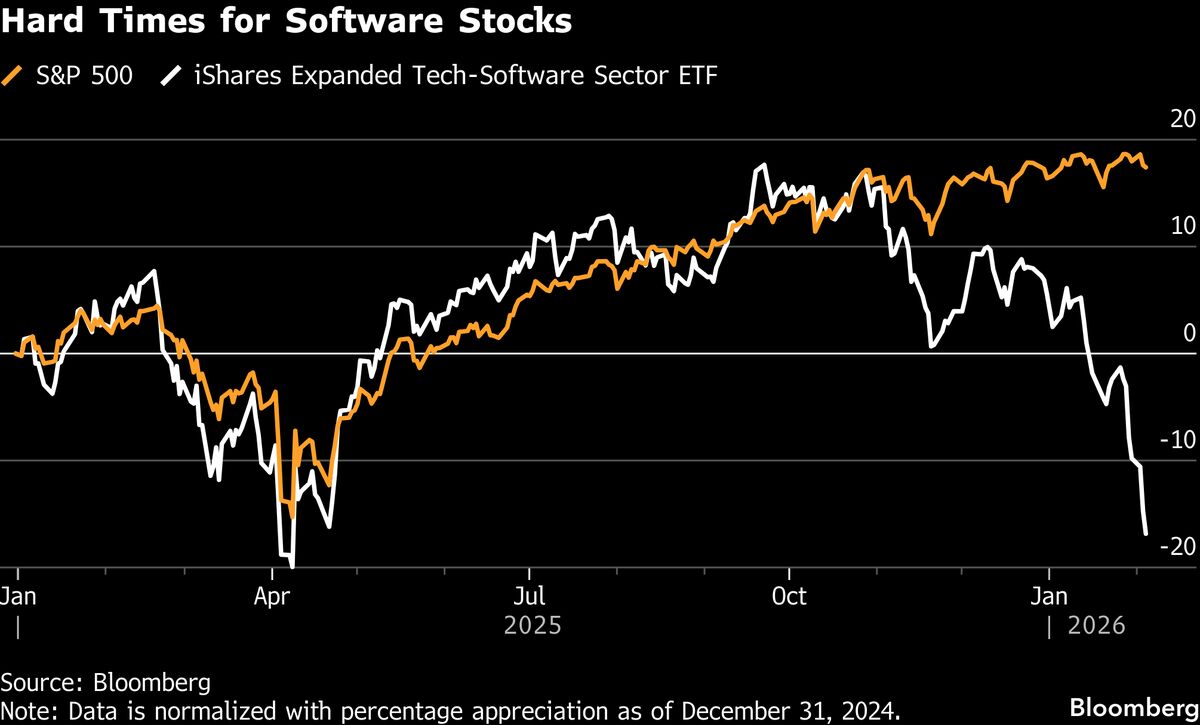

- What’s Behind the ‘SaaSpocalypse’ Plunge in Software Stocksby Lynn Doan, Carmen Reinicke on February 4, 2026 at 10:55 pm

Since ChatGPT arrived on the scene some three years ago, analysts have been warning that entire industries, including software programming, legal services and film production, are at risk of being disrupted by artificial intelligence.

- Flagship-Backed Drug Firm Generate Biomedicines Files for US IPOby Bailey Lipschultz on February 4, 2026 at 10:46 pm

Generate Biomedicines Inc. filed for an initial public offering, joining a growing list of biotechnology firms to leap to public markets as investors embrace the sector.

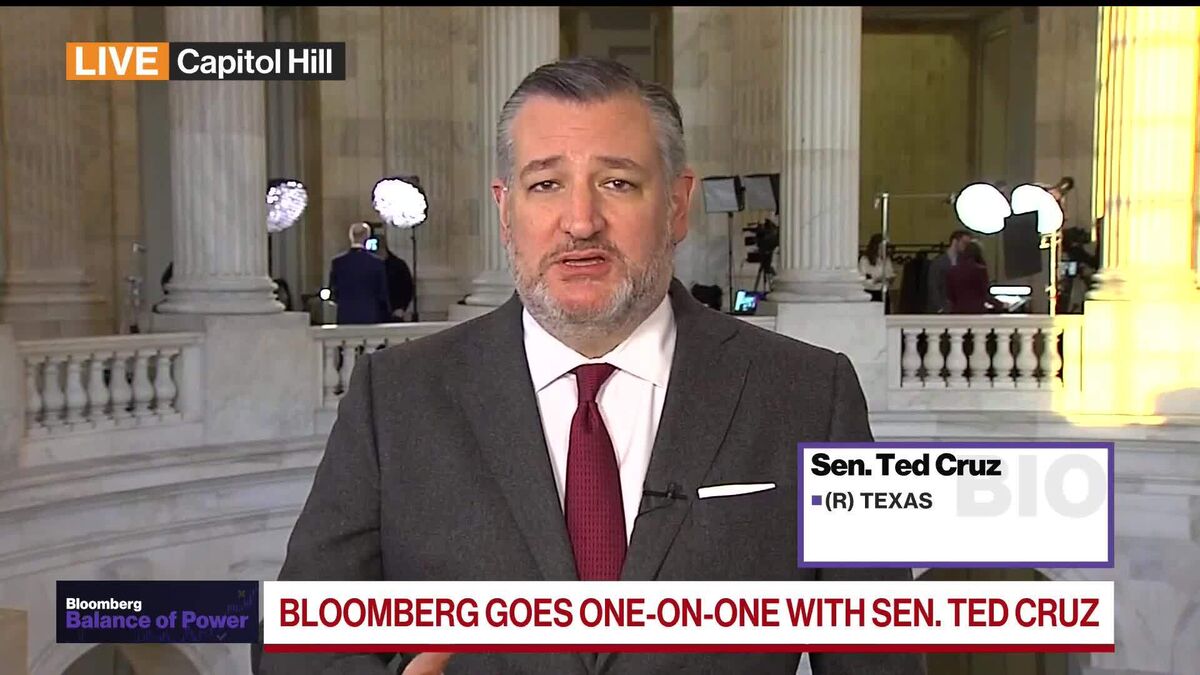

- Senator Ted Cruz Defends ICE and Supports Self-Driving Carson February 4, 2026 at 10:44 pm

Senator Ted Cruz of Texas discusses the recent ICE enforcement controversies in Minneapolis and the Senate hearing on the safety of autonomous vehicles, advocating for a national regulatory framework. He speaks on "Balance of Power: Evening Edition." (Source: Bloomberg)

- Asian Stocks to Fall as Tech-Led Drop Gains Pace: Markets Wrapby Richard Henderson, Anand Krishnamoorthy on February 4, 2026 at 10:17 pm

Asian stocks were set to follow US shares lower as selling in technology stocks gained pace and investors rotated out of the sector and into a broader range of companies.

- Higher Private Equity Returns Help Fuel Jump in MetLife Profitby Edison Wu on February 4, 2026 at 10:07 pm

MetLife Inc.’s fourth-quarter earnings beat analysts’ expectations, with higher private equity returns propelling a jump in the insurer’s investment income.

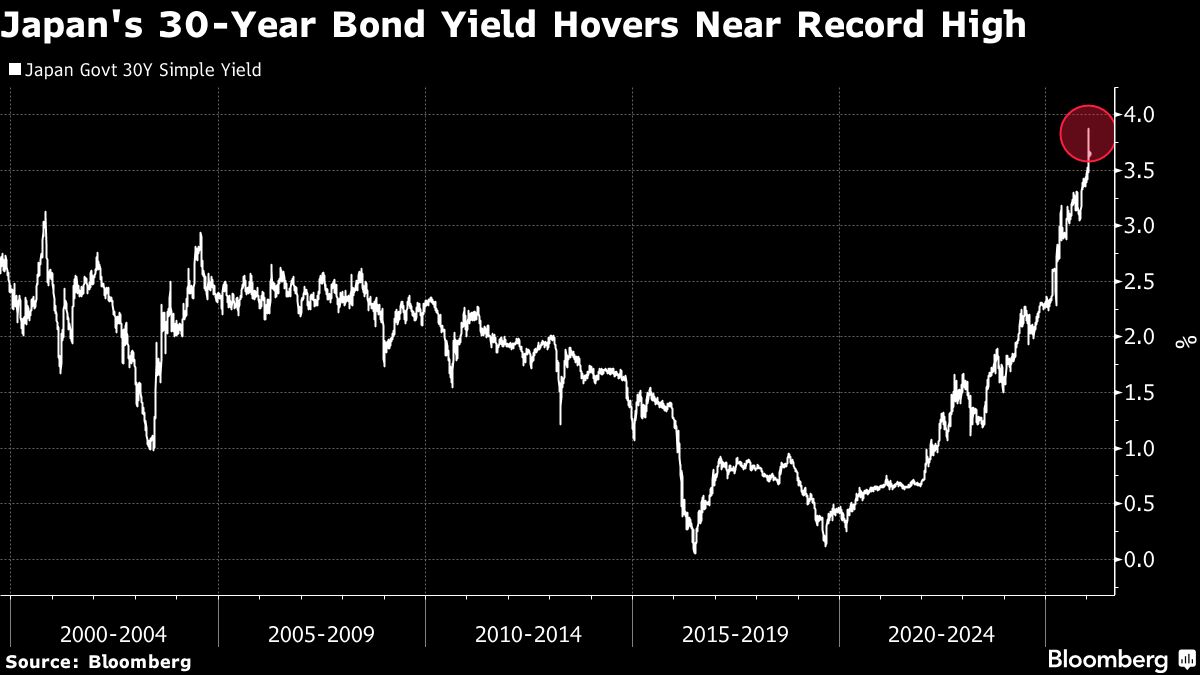

- Japan’s Weekend Election Spurs Caution Before 30-Year Bond Saleby Mia Glass on February 4, 2026 at 10:00 pm

Traders are watching out for signs of weak demand at Thursday’s sale of 30-year Japanese government bonds, just days before Sunday’s closely monitored lower house election.

- Tricolor Founder Can Tap Insurance for Fraud Defense, Judge Saysby Steven Church on February 4, 2026 at 9:53 pm

Tricolor Holdings founder Daniel Chu, who faces federal fraud charges related to the collapse of the subprime auto-loan firm, won court approval to use company insurance policies to pay for his defense costs, a judge ruled Wednesday.

- Singer’s Elliott Urges Judge to Toss Lawsuit by Texas PE Firmby Sabrina Willmer on February 4, 2026 at 9:11 pm

Paul Singer’s Elliott Investment Management Inc. asked a judge to dismiss a lawsuit by a Texas private equity firm that claims “tens of millions of dollars” are being withheld after the sale of oil and gas assets.

- NYC, NJ Business Groups Urge Trump to Restore Gateway Fundsby Michelle Kaske on February 4, 2026 at 8:51 pm

Business leaders, labor groups and transit advocates are calling on the Trump administration to restore funding to a $16 billion rail tunnel that links New Jersey and Manhattan as work on the project is set to shut down on Friday absent federal dollars.

Trending

- Why More Investors Are Turning Back to Gold in Uncertain Times

- Goldhaven Announcement

- DeSci: How Decentralized Science is Transforming Research and Innovation

- Why DeSci Is Transforming Science—and How Ethereum Makes It Possible

- SpaceX Launches Starlink Satellites on ‘American Broomstick’ and Lands Rocket at Sea

- The China-Built Ship that Pulled a US Navy Jet Wreck from the South China Sea

- Anti-War Protests Intensify in World Along with Crackdown

- US Nod to Nato for Sending Fighter Jets to Ukraine Finds no Takers

Market News

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

© 2026 ThemeSphere. Designed by ThemeSphere.