- Nvidia Gets US License for Small Amount of H200 Exports to Chinaby Ian King, Mark Anderson on February 26, 2026 at 2:00 am

Nvidia Corp. said it secured a license to ship a small number of its less advanced H200 chips to customers in China, inching forward in its bid to return to the world’s largest semiconductor market.

- Anthropic’s Pentagon Showdown Is About More Than AI Guardrailsby Katrina Manson, Maggie Eastland, Kendall Taggart on February 26, 2026 at 1:05 am

The high-stakes conflict between the Defense Department and a $380 billion tech powerhouse goes to the heart of just how far AI can go in warfare.

- Stocks Rise as Nvidia Surges on Earnings Beat | The Close 2/25/2026on February 26, 2026 at 12:13 am

Bloomberg Television brings you the latest news and analysis leading up to the final minutes and seconds before and after the closing bell on Wall Street. Today's guests are JPMorgan Asset Management’s Meera Pandit, CAVA's Brett Schulman, DA Davidson’s Gil Luria, Oak Hill Advisors’ Glenn August, RBC Capital Markets’ Amy Wu Silverman, Strategic Value Partners’ Victor Khosla, Wedbush Securities’ Matt Bryson, OpenAI’s Zack Kass, and Scribe’s Jennifer Smith. (Source: Bloomberg)

- Baidu’s Swift $11 Billion Selloff Shows Struggle to Meet AI Hypeby Charlotte Yang on February 25, 2026 at 11:50 pm

A 20% slide in Baidu Inc.’s shares over the past month serves as a crucial reminder for companies in China’s rapidly intensifying artificial intelligence race: investors are demanding tangible results.

- MercadoLibre CFO on 4Q Earnings, LatAm E-Commerce Trendson February 25, 2026 at 11:24 pm

MercadoLibre CFO Martin de los Santos joins Bloomberg Businessweek Daily to discuss the company's fourth quarter earnings results as the Uruguay-based e-commerce firm sees a miss in quarterly net income, but growth in its fintech and e-commerce units. He also discusses the company's success with its digital payments platform, e-commerce adoption and trends among Latin American consumers, and more. de los Santos speaks with Carol Massar and Tim Stenovec. (Source: Bloomberg)

- AI Adviser Zack Kass Says Software May Have Been in a Bubbleon February 25, 2026 at 10:52 pm

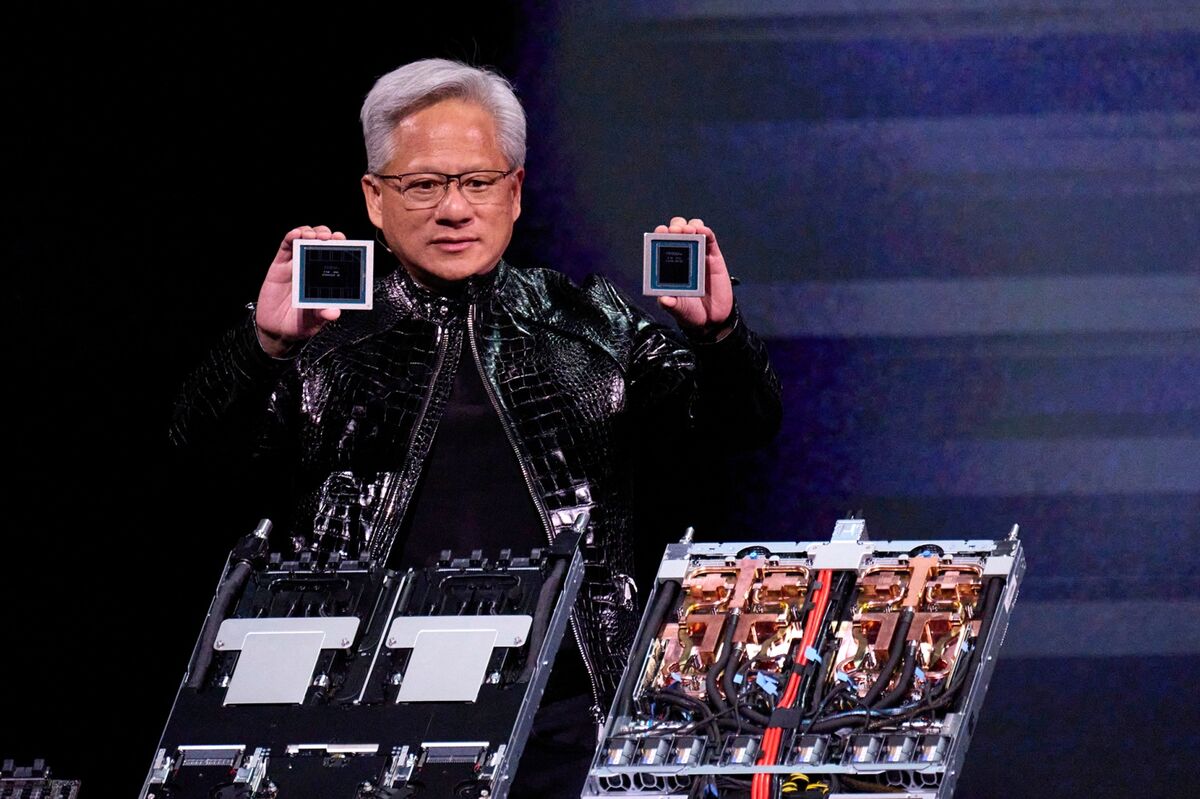

Zack Kass, global AI adviser and former head of Go-to-Market at OpenAI, says software stocks instead of AI might have been in a bubble. Speaking on "Bloomberg The Close," Kass also addresses the optimism expressed by Nvidia's CEO Jensen Huang regarding the rapid growth of agentic AI applications. (Source: Bloomberg)

- Asian Stocks Climb, Nvidia Trims Post-Result Gains: Markets Wrapby Anand Krishnamoorthy, Winnie Hsu on February 25, 2026 at 10:43 pm

Asian shares extended their gains to a fourth straight day as turmoil driven by concerns over the impact of artificial intelligence eased, with gains tempered by a muted response to Nvidia Corp.’s upbeat sales forecast.

- Victor Khosla Sees 'Fat' Tail Risk in Credit Marketson February 25, 2026 at 10:32 pm

Victor Khosla, founder and CIO of Strategic Value Partners, warns about the contagion risk facing the credit market from the selloff in software stocks. He speaks on "Bloomberg The Close." (Source: Bloomberg)

- C3.ai to Cut 26% of Workforce Following CEO Transitionby Brody Ford on February 25, 2026 at 10:14 pm

C3.ai Inc., a maker of data analysis software, is cutting about a quarter of its workforce after the appointment of a new chief executive officer.

- Zoom Gives Weaker Profit Outlook in Push to Expand Product Suiteby Brody Ford on February 25, 2026 at 10:07 pm

Zoom Communications Inc. gave a profit outlook that fell short of analysts’ estimates, suggesting higher costs for the company while it aggressively pitches its expanded suite of products.

- Nvidia Says Customers Are Racing to Invest in AI Computeon February 25, 2026 at 10:03 pm

Bloomberg Tech Host Ed Ludlow and Jay Goldberg, Senior Analyst at Seaport Research Partners, react as Nvidia earnings cross the wire. The world’s most valuable company says fiscal first-quarter sales will be about $78 billion and customers are racing to invest in AI compute.

- The Key Takeaways From Nvidia's Earnings and Forecaston February 25, 2026 at 10:00 pm

Matt Bryson, managing director of equity research, hardware at Wedbush Securities, reacts to Nvidia's fourth-quarter results and forecast. He speaks on "Bloomberg The Close." (Source: Bloomberg)

- AI Mistakes Are Infuriating Gamers as Developers Seek Savingsby Vlad Savov on February 25, 2026 at 10:00 pm

Games and AI, seemingly a perfect match, are off to a rocky start

- Snowflake Gives Revenue Outlook That Fails to Impress Investorsby Brody Ford on February 25, 2026 at 9:42 pm

Snowflake Inc. gave an outlook for quarterly sales that was in line with estimates, disappointing investors who were looking for a stronger showing to overcome jitters about the software industry’s viability in the age of AI.

- Investors Await Nvidia’s Earnings, Anthropic Loosens Safety Policy | Bloomberg Tech 2/25/2026on February 25, 2026 at 9:40 pm

Bloomberg’s Caroline Hyde and Ed Ludlow preview Nvidia’s earnings as investors look for fresh clues on AI’s market impact. Plus, Anthropic loosens its central safety policy amid a growing dispute with the US Defense Department over guardrails. And, Sequoia partner Alfred Lin discusses AI’s impact on financial services alongside the CEO of his new portfolio company, Rowspace's Michael Manapat. (Source: Bloomberg)

- Trader Bets $14 Million That Losing Warner Bid Would Be Win for Netflixby David Marino, Youkyung Lee on February 25, 2026 at 9:37 pm

An options trader appears to be betting almost $14 million that Netflix Inc. will win should it lose out on its bid to acquire Warner Bros. Discovery Inc.

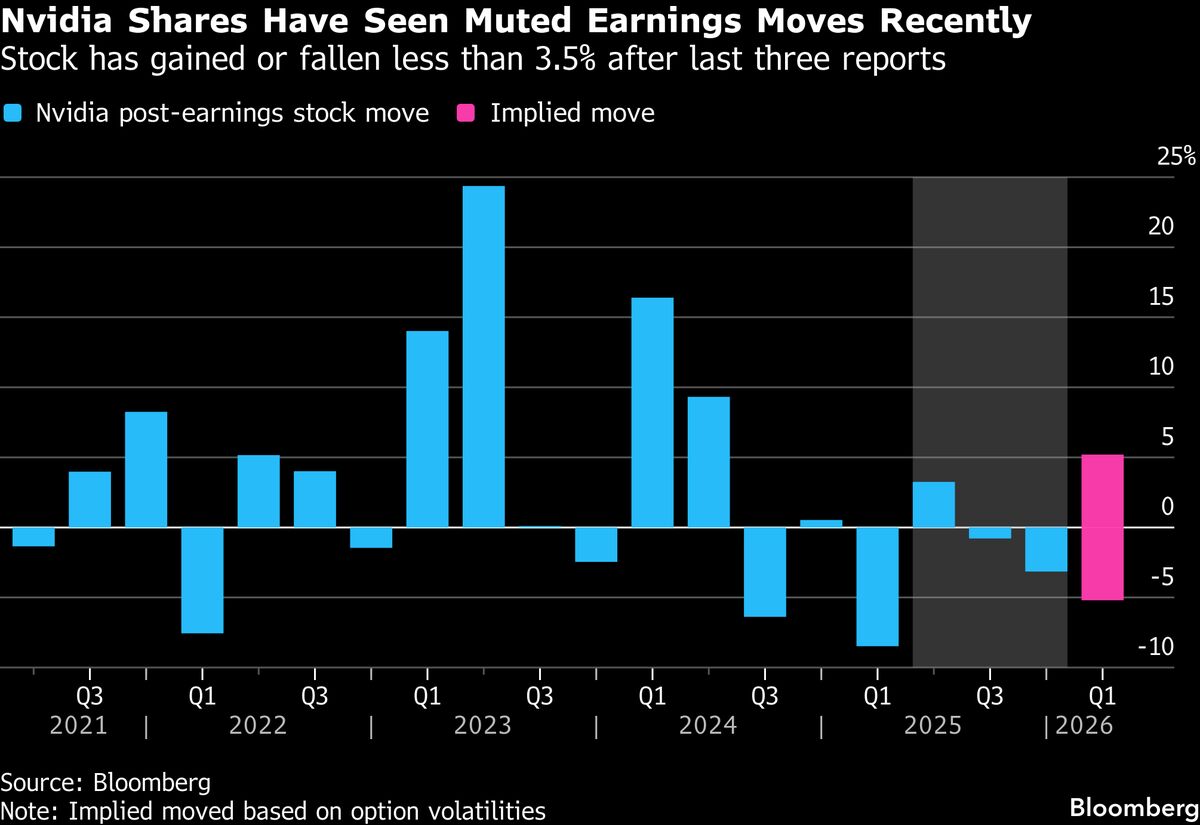

- Nvidia Investors Give Tepid Reaction to Upbeat Forecastby Ian King on February 25, 2026 at 9:34 pm

Nvidia Corp., the dominant maker of artificial intelligence processors, failed to impress investors with its latest sales forecast, signaling that concerns about an overheated AI economy will continue to dog the company.

- Nubank’s AI Model Helps Fuel Net Interest Income Expansionby Matheus Piovesana on February 25, 2026 at 9:17 pm

Nu Holdings Ltd.’s credit margins increased in the fourth quarter, as Latin America’s largest fintech expanded its use of a credit model powered by artificial intelligence.

- Salesforce Gives Disappointing Sales Outlook, Feeds AI Fearsby Brody Ford on February 25, 2026 at 9:07 pm

Salesforce Inc. gave a lukewarm outlook for sales growth in the new fiscal year, fueling investors’ worries that the software giant will lose out to new competitors in the age of AI.

- AMD to Buy $150 Million of Nutanix Stock in New Partnershipby Brody Ford on February 25, 2026 at 9:01 pm

Advanced Micro Devices Inc. will buy $150 million in Nutanix Inc. stock as part of a new partnership that also includes joint engineering and sales efforts.

Trending

- Why More Investors Are Turning Back to Gold in Uncertain Times

- Goldhaven Announcement

- DeSci: How Decentralized Science is Transforming Research and Innovation

- Why DeSci Is Transforming Science—and How Ethereum Makes It Possible

- SpaceX Launches Starlink Satellites on ‘American Broomstick’ and Lands Rocket at Sea

- The China-Built Ship that Pulled a US Navy Jet Wreck from the South China Sea

- Anti-War Protests Intensify in World Along with Crackdown

- US Nod to Nato for Sending Fighter Jets to Ukraine Finds no Takers

Technology

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

© 2026 ThemeSphere. Designed by ThemeSphere.